- Social Engineering

- January 30, 2026

Pig butchering crypto scams have already become a significant threat on the internet. What makes them so effective is not just the financial angle; it’s the way scammers blend technology, patience, and emotional influence to draw people in. These scams usually start off in the most common way possible. It can be a friendly message on a dating application, a casual talk on social media, or a sudden text, which initially seems to be harmless.

Numerous individuals who have experienced these scams report having the same experience: the communication is friendly, predictable, and reliable. The scammer learns about the victim and his/her routine and interests. They choose to communicate in a style that makes the relationship not seem forced.

Because these scams often follow the same emotional patterns as romance scams, understanding how romance fraud works can help victims recognize warning signs earlier. These scams continue to evolve, understanding the environment in which they operate has become just as important as recognizing the tactics themselves. This guide is a breakdown of all the information you need to know about what exactly this scam is, how to avoid it early on, and what to do in case you encounter a similar scenario.

What Is a Pig Butchering Crypto Scam & How It Works

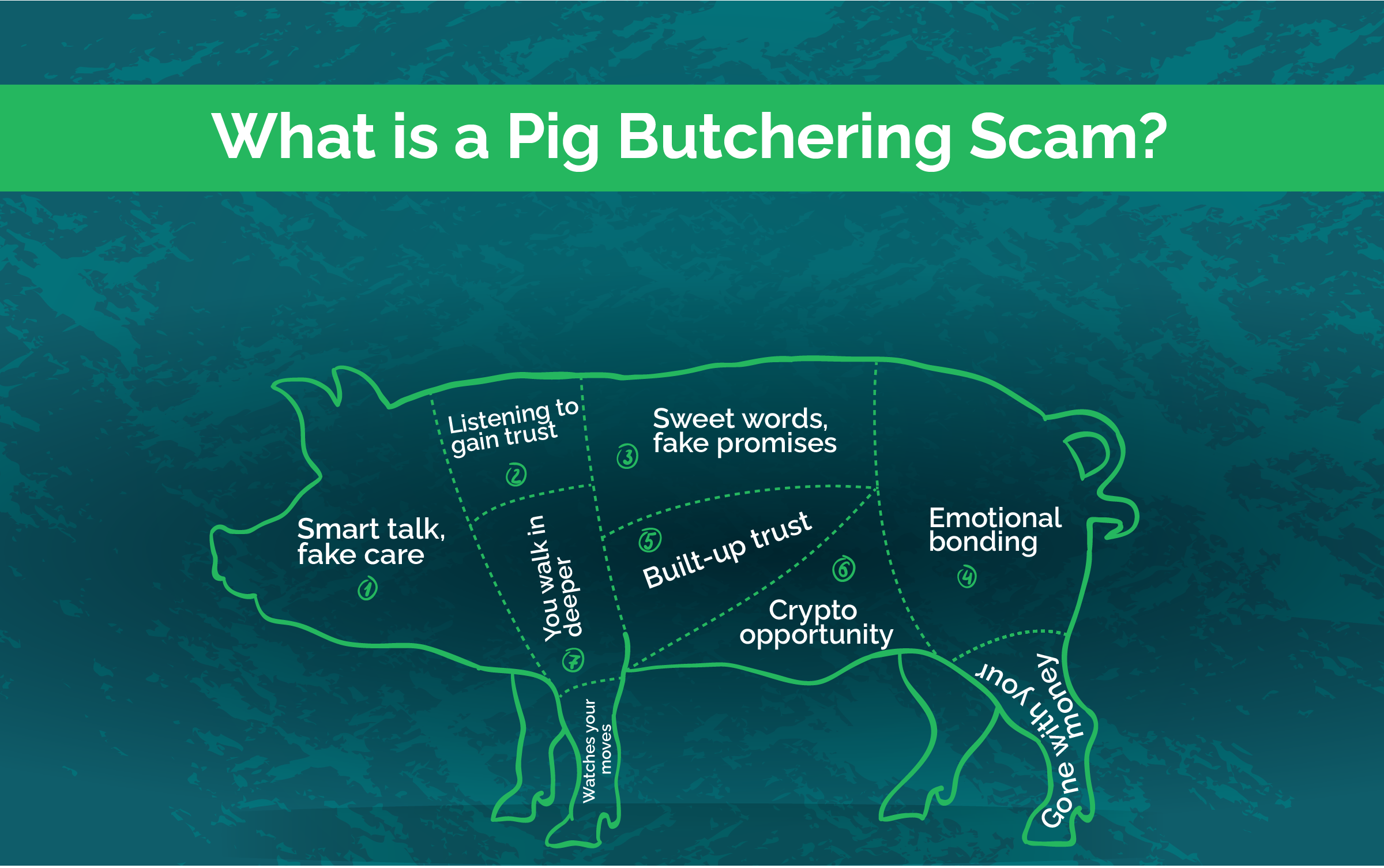

A pig butchering crypto scam is a pyramid scheme in which a scammer gains trust with a person and gradually persuades them to invest in phony cryptocurrency ventures. The name comes from the way scammers “fatten up” the victim with attention, reassurance, and false confidence before taking their money.

These are frauds that are not based on immediate urgency and blatant threats. Instead, they are constructed on a slow buildup that is personal and considered well thought out. Here’s how they typically unfold today:

- Initial Contact: The scammer contacts via dating applications, social media, messaging applications, or even texts on a wrong number. The first interactions are friendly and consistent.

- Building a Relationship: They communicate weekly or even for months. The aim is to be real-to-life- to tell stories, be interested, and gradually enter into the life of the victim.

- Cryptocurrency Investment Introduction: When the trust is built up, the scammer refers to cryptocurrency trading or investing. They put it in the context of what they have already successfully done and frequently provide screenshots of fake sites to make it sound authentic.

- Directing the First Investment: The victim is brought to the site or application that is intended to resemble an actual crypto exchange, yet it is run by the fraudsters. The amount of money that is presented on the dashboard is artificial to gain trust.

- Promotion of Large Deposits: As the fake profit increases, the more the scammer stimulates the victim to invest. They propose opportunities that are limited in time, offer larger returns, or involve sophisticated trading techniques.

- Blocking Access: As soon as the victim attempts to withdraw money or even ceases to deposit money, the scammer vanishes, or the site becomes unavailable. By now, the money is already transferred via several wallets and is inaccessible.

All this is done to make this process safe, natural, and believable. The scammers do not use coercion, and that is the reason why most people are not aware of what is happening until the last moment.

Where Pig Butchering Crypto Scams Usually Start (Common Entry Points)

Pig butchering scams often begin in places where casual conversations feel natural. Scammers choose platforms where people are open to meeting new connections, which makes their approach easy to disguise. Here are the most common starting points:

1. Dating Apps and Beyond

Many scams begin on dating platforms like Tinder, Bumble, Hinge, and similar apps. These spaces allow scammers to build a personal connection quickly.

However, it’s important to know that these scams are not limited to dating apps. Scammers often extend the same tactics across social and messaging platforms, making this the starting point for many, but not the only one.

2. Social Media

Scammers reach out through Instagram, Facebook, and LinkedIn, often starting with friendly comments, reactions, or direct messages that feel harmless and genuine.

3. Messaging Apps

Apps like WhatsApp, Telegram, and LINE give scammers more privacy and flexibility. They often guide the conversation here early on.

4. “Wrong Number” or Unexpected Texts

A simple message such as:

“Hi, is this Sam?”

or

“Sorry, wrong number.”

is often intentional. It creates an easy opening for casual conversation, which may continue if the recipient responds.

5. Online Groups and Communities

Scammers sometimes join:

- interest-based groups

- hobby communities

- investment forums

- local area pages

They do this to appear approachable before moving to private messages.

Warning Signs of a Pig Butchering Crypto Scam (How to Spot Early Red Flags)

Identifying a pig butchering crypto scam early can make all the difference. These schemes are built on patience, trust-building, and emotional influence, which means the warning signs often appear gradually. Paying attention to small shifts in behavior or communication can help you recognize the risk before money is involved.

1. Quick Emotional Attachment

A scammer may try to build closeness unusually quickly. They message often, share personal stories, and express a strong interest early on. The goal is to create trust before introducing investments.

2. Sudden Shift to Crypto Discussions

Once the connection feels secure, conversations turn toward crypto trading. They may show screenshots or dashboards that appear convincing but are entirely fabricated.

3. Pressure to Deposit Increasing Amounts

After a small initial investment, they start pushing for larger deposits. Phrases like “exclusive opportunity” or “time-sensitive trade” are common techniques to encourage quick action.

4. Difficulties With Withdrawals

When you try to access your funds, delays begin. Scammers may claim technical issues, request extra fees, or say your account needs additional “verification” before releasing the money.

5. AI-Enhanced Identities

The scammer can use AI-created photos, videos, or voice calls to sound or look more realistic. These are used to make them have a formal and unified identity across platforms.

6. Spoof or Unregistered Trading Systems.

Most scammers refer their victims to sites that appear professional yet are not regulated and traceable. Such websites tend to replicate actual crypto exchanges so as to escape detection.

The signs tend to be combined, forming a pattern that becomes evident over time. Early identification of them empowers your efforts to prevent financial exploitation and gives you a step towards the next stage: realizing how new technologies such as AI and deepfakes are evolving these types of scams to be even more sophisticated.

How Tech Is Changing Pig Butchering Frauds (AI, Deepfakes and Advanced Manipulation)

Pig butchering frauds are increasingly difficult to spot since the swindlers are no longer counting on the use of straightforward messages or appropriated pictures. New technology has rendered these schemes more believable, more organized, and even harder to prove by the ordinary individual. The importance of these tools and how they are being used is key in identifying risks at early stages.

-

AI-Generated Personalities

Nowadays, scammers can also create photos, short videos, and even lifestyle pictures with the help of AI tools and make them appear to be real. All these identities are designed in a manner that seems to be consistent across dating apps, messaging services, and social networks so that they would become more difficult to doubt.

-

Deepfake Voice and Video Calling

There are other scammers who go a step further and use modified voice technology or deepfake video filters whenever making calls. This assists them in sustaining the pretense that they are the one in their profile, which minimizes doubt in case the victims anticipate real-time communication.

-

Chat and Response Patterns Automation

The AI scripts assist scammers in having long, emotionally charged dialogues. These tools enable them to be in touch with several targets at all times, which enhances the likelihood of success, besides making the discussions personalized.

-

More Realistic Simulated Trading Systems

These stock brokers have evolved into highly developed app-like investment interfaces, which resemble real crypto trades. The real-time charts, balance updates, and profit indicators are also displayed on these sites, and it is hard to discern between actual performance and fake performance.

These developing technologies are not new tools anymore but a bigger plan to make scams sound believable even during the initial contacts. The awareness of these developments to the readers keeps them updated about the rapid rate at which fraud schemes are evolving, and it makes them ready to bind into the next section on how to ensure that they protect themselves and check out the platforms before committing their funds.

How to Avoid Falling Prey to Pig Butchering Cryptocurrency Scams

Safety on the Internet is reduced to some obvious habits and thorough verification. Such practices can assist you in pruning out the real contacts from the fake ones and also keep your financial details safe.

1. Confirm identity on your own

It is always good to first verify who you are dealing with before engaging them in financial discussions. Examine discrepancies, weak Internet activity, and reluctance toward natural video calls, which are typical indicators of a fake identity.

2. Study the systems in place before investing

Invest only in platforms that you are discovering. Make sure that the exchange is licensed, consult reliable sources, and ensure that there are no warnings issued by regulators. Counterfeit sites may look legitimate, yet they cannot be verified.

3. Don’t take up pressure investment talks

Fraudsters tend to push a sense of urgency insofar as there is an opportunity that is so exclusive or time-related. Earning investment never has a time limit, and it is not based on feeling but on perseverance.

4. Guard your purse and login data

Do not share seed phrases, personal keys, passwords, or entire account displays. This information will not be asked by secure platforms or real advisors in any case.

5. Utilize secure and open channels of communication.

When an individual does not want to use regular video calls, insists on private messaging apps at once, or does not want outside opinions, he/she should take it as a warning. Real relationships involve transparency.

6. Belt your buck; go slow when in doubt

When something does not feel normal (even a bit), then give it another look. Avoiding financial loss in the future can be achieved by asking questions early on.

Such safeguards can make the reader aware and minimize their exposure, which is then followed by the second part of what to do should you have already committed or have a feeling that a scam is in progress.

What to Do If You Suspect a Pig Butchering Crypto Scam

Realizing something feels wrong can be unsettling, but taking the right steps early can protect your remaining funds and improve your chances of recovery. Here’s what to do immediately if you think you’ve been targeted or have already invested.

1. Stop All Transfers and Communication

Pause deposits right away and avoid replying to the scammer. Any continued contact can lead to pressure, emotional manipulation, or new excuses to send more money.

2. Document Everything

Save screenshots, transaction IDs, platform URLs, usernames, chat logs, and any voice or video interactions. These details help investigators, banks, and law enforcement understand what happened.

3. Report the Scam on Official Channels

Report the incident to federal and state authorities. Submitting a complaint helps:

- Create a record of your case

- Support larger investigations

- Increase chances of tracing fraudulent activity

4. Secure Your Accounts and Devices

Change passwords, enable two-factor authentication, and review all connected apps or wallets. If you shared sensitive wallet information, move your assets to a new secure wallet immediately.

5. Do Not Pay “Recovery Fees” or Unexpected Charges

Scammers often return with a second attempt, pretending to be investigators or platform representatives who can “unlock” funds for a fee. Legitimate agencies never request upfront payments for releasing funds.

6. Seek Guidance From a Professional Recovery Team

Crypto-related scams are complex, especially when fake exchanges, international actors, or blockchain transactions are involved. Speaking to professionals who specialize in digital asset tracing can give you clarity, help you understand your options, and guide you through realistic next steps.

This is where Financial Recovery Experts can support readers by offering informed guidance without pressure or unrealistic promises.

Staying Informed Is Your Strongest Defense

Pig butchering scams continue to evolve, but so does awareness. The more you understand how these schemes operate, emotionally, technologically, and financially, the better equipped you are to protect yourself and those around you. Every red flag you recognize early is a step toward safeguarding your assets and maintaining confidence in your online interactions.

If you’ve already encountered one of these scams or feel uncertain about an ongoing situation, reaching out for guidance can provide clarity and direction. Financial Recovery Experts is available to help you evaluate what happened, understand your options, and take the next steps with confidence.

Need support? Connect with Financial Recovery Experts today and get the guidance you deserve.

FAQs (Frequently Asked Questions)

A pig butchering crypto scam is a long-term fraud in which a scammer builds trust through friendly or romantic communication, then gradually guides the victim into investing in fake cryptocurrency platforms. The scammer shows fabricated “profits” to encourage larger deposits, but once the victim tries to withdraw money, the scammer disappears or blocks access. It is called “pig butchering” because the victim is “fattened up” with trust before being financially exploited.

Early signs of a pig butchering scam include fast emotional bonding, sudden interest in crypto trading, pressure to make quick deposits, and difficulty verifying the person’s identity outside the app. Scammers may also use AI-generated photos, deepfake videos, or highly polished fake trading dashboards. If someone introduces investments quickly or encourages secrecy, treat it as a major warning sign.

Recovery is possible in some of the pig butchering scam cases, especially if action is taken quickly and the transactions are traceable on the blockchain. Reporting the fraud, preserving all evidence, and seeking support from professionals who understand crypto tracing can improve the chances of identifying where funds moved. While not all losses can be fully recovered, timely steps significantly increase the possibility of partial or full recovery.

To run pig butchering scams, scammers typically begin on dating apps, social media platforms, messaging apps, or random text messages known as “wrong-number” outreach. After building trust, they move victims to encrypted apps like WhatsApp or Telegram and introduce them to fraudulent crypto platforms. These platforms often mimic legitimate exchanges but are controlled entirely by the scammer.

You can report a pig butchering crypto scam to multiple official channels: the FBI’s Internet Crime Complaint Center (IC3), the Federal Trade Commission (FTC), and your state’s consumer protection office. Provide all available details—transaction IDs, platform links, screenshots, and communication history. Reporting creates a formal record, supports ongoing investigations, and increases the chances that authorities or recovery teams can trace your case.