- Crypto

- July 22, 2025

Fake AI Trading Bots: The Truth Behind Fake Profit Claims

AI trading bots have become one of the most talked-about tools in the online investment space. Across websites, social media platforms, and video ads, these bots are promoted as a way to earn a consistent daily income. This can range from $500 to $2,000 per day, all without needing to monitor the markets yourself. But behind the appealing promises lies a serious problem.

A large number of these so-called AI trading bots are not genuine. They are cleverly crafted scams that use terms like "AI-powered," "machine learning," and "automated profits" to appear advanced and trustworthy. According to the Federal Trade Commission (FTC), Americans lost over $12.5 billion to investment scams in 2024 alone. The large portion of which involved fraudulent trading schemes and misleading technology platforms.

In the next sections, we’ll look at how these scams operate, the red flags you should look for, and the simple steps you can take to avoid getting caught in a fake trading bot scam.

What Real Trading Bots Do?

Over the past several years, various financial regulators have investigated these platforms. Organizations such as the FTC, FCA, and blockchain analysis companies have reviewed consumer complaints and examined how these systems operate. Their findings reveal a consistent pattern of deception, manipulation, and financial loss, with profits flowing only to the individuals behind these fake operations.

Big banks like Chase and Goldman Sachs use computer programs to buy and sell stocks. These programs are complex and cost millions of dollars to build. Teams of skilled experts work on them for years.

Even with all that money and expertise, these systems still lose money sometimes. The stock market is unpredictable. Nobody can guarantee profits, not even the biggest banks in the world.

So, when a random company claims its $200 bot can beat Wall Street, that should raise immediate red flags.

The Role of AI in Trading

Companies are using AI to help with trading, but their systems are incredibly expensive and complex. They employ teams of scientists and mathematicians who work on these systems full-time. Even these advanced systems can't guarantee profits.

The stock market is influenced by too many unpredictable factors: wars, natural disasters, company scandals, and economic changes. The idea that someone can create a perfect trading system and sell it for a few hundred dollars is not real.

Here's the truth nobody wants to hear: building wealth is slow and sometimes boring.

- Start by learning the basics of investing. There are plenty of free resources online from reputable sources like government websites and established financial companies.

- Open an account at a reputable, well-established brokerage firm with a long history. Select a company that is transparent about its business, has an established history, and is completely licensed by financial regulators.

- Invest regularly in diversified funds. This spreads your risk across many different stocks and bonds.

- Be patient. Real wealth building takes years, not days.

Consider talking to a financial advisor if you have significant money to invest. Look for fee-only advisors who don't earn commissions from selling your products.

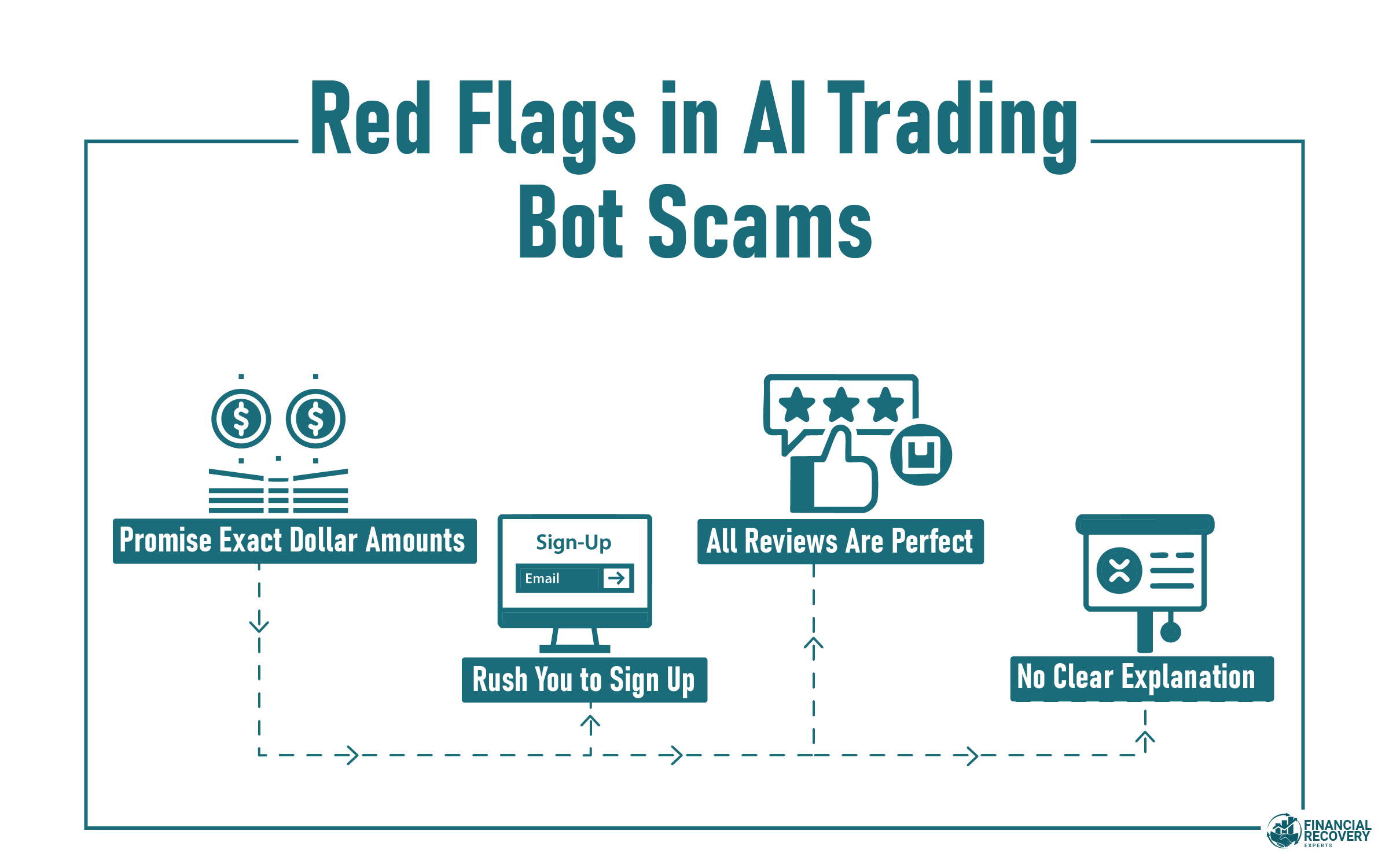

4 Red Flags in AI Trading Bot Scams To Look For

While each scam might look a little different, most of them follow the same pattern. They’re carefully designed to trick people. Below are some of the most common red flags to keep in mind:

1. They Promise Exact Dollar Amounts

Real trading is unpredictable. Markets move based on news, supply and demand, and investor sentiment. Some days may bring profit, while others result in loss. Any platform claiming you’ll make exactly $1,500 or any fixed amount every single day is not being honest. No legitimate trading system can guarantee fixed daily returns.

The scammers employ such promises in order to generate anticipation and attract individuals who seek quick, passive income. Such numbers are actually not real but fabricated to make users invest in a hurry.

2. They Rush You to Sign Up

Messages like "Only 24 hours left!" or "Limited spots remaining!" are classic pressure tactics. These are designed to create urgency so users don’t stop to think or do proper research.

Legitimate financial services encourage careful consideration and due diligence. They don’t rely on countdown timers or emotional pressure to gain clients. Scammers, on the other hand, want your payment or deposit before you realize it's a trap.

3. Everyone Loves Them (Supposedly)

If you check online reviews or comments and find that every user had the same “amazing” experience, made the same amount of money, withdrew funds easily, and never had a complaint, it’s a red flag. No real investment product has 100% positive feedback.

Scam sites purchase fake reviews, produce fake testimonials, and even have AI photos created to appear trustworthy. Be sure to inspect for authenticity signs in reviews and review if the site is mentioned on independent sites like Trustpilot, Reddit, or personal finance forums.

4. They Won’t Explain How It Works

If you ask how the system works, genuine platforms will usually walk you through the process in simple terms: how data is analyzed, how trades are executed, and what kind of strategy is followed.

Scammers often respond with vague, confusing explanations filled with words like “AI-powered engine,” “proprietary algorithm,” or “quantum trading model.” The truth is, they have nothing real to explain, so they rely on flashy terms to sound impressive while hiding the lack of a functional system.

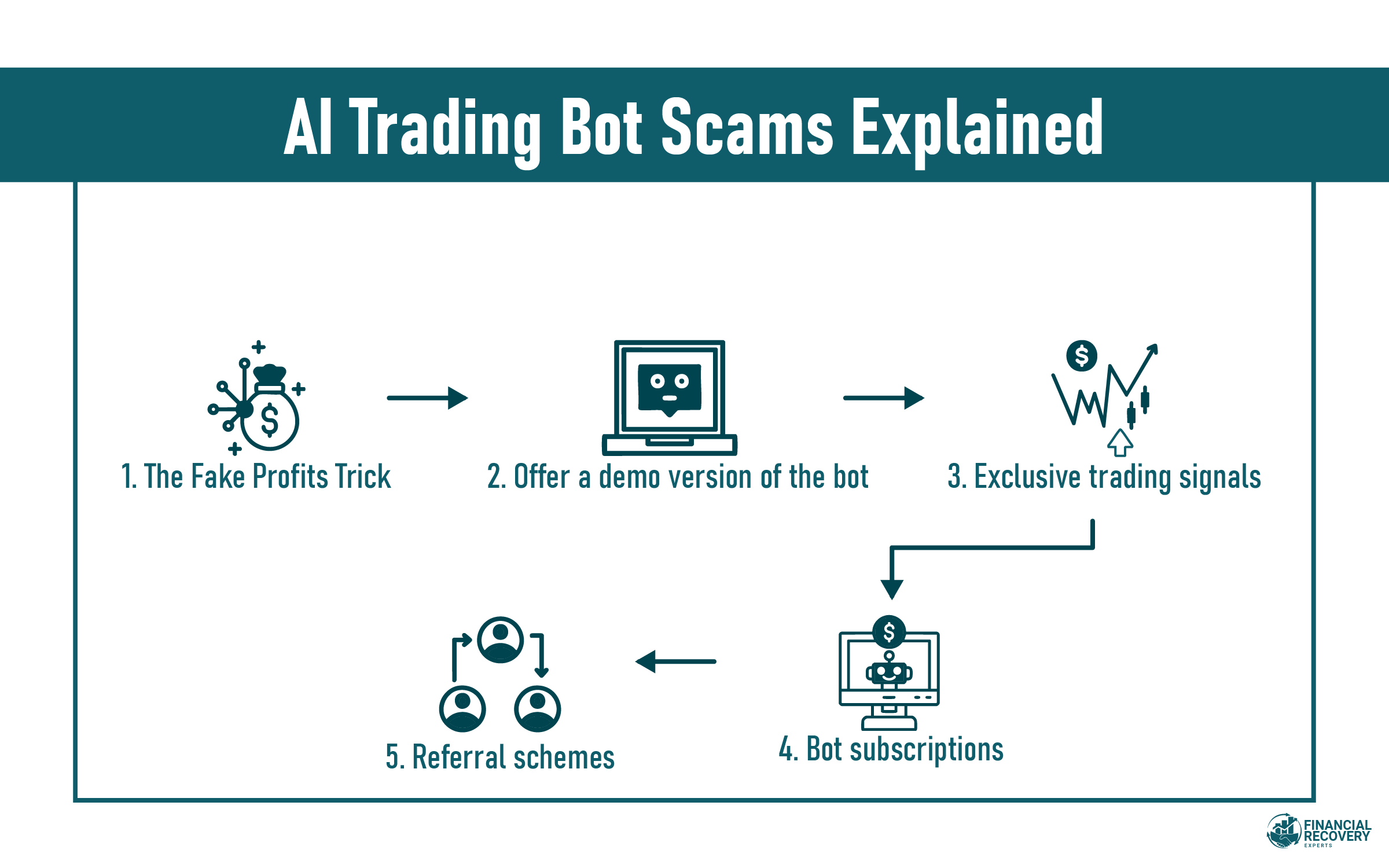

How AI Trading Bot Scams Actually Work?

Once you’re in, these platforms use several deceptive tactics to keep you believing you’re making money until it’s too late. Here’s how many of these scams operate:

1. The Fake Profits Trick:

After you make your first deposit, the platform starts showing you a growing account balance on a well-designed dashboard. It looks like the bot is working; you see $100 turn into $200, then $400.

But what you're seeing isn't real. The platform is not trading at all. It’s simply showing fake numbers to build your confidence. Once you try to withdraw funds, they’ll come up with excuses like needing to pay taxes, upgrade to a premium account, or cover “verification fees.” These are just tactics to squeeze more money from you.

2. The Signal Scam:

Some scams don’t ask for a big deposit upfront. Instead, they sell "exclusive trading signals" or bot subscriptions for a monthly fee, often $50 to $200. These signals are usually copied from free websites, randomly generated, or based on outdated strategies.

They’ll highlight the few trades that worked as proof of success while quietly ignoring the majority that failed. Over time, users lose money following bad tips, while the scammer keeps collecting subscription payments.

3. The Pyramid Version:

Some platforms operate more like referral schemes than trading bots. Users are encouraged to bring in new investors, often with promises of commissions or bonuses for each referral. The actual trading part is secondary or fake altogether.

In reality, it’s a pyramid scheme. New money from incoming users is used to pay earlier users, giving the illusion that the system works. Eventually, when new sign-ups slow down, the entire structure collapses, and most users lose their money.

4. The Demo Lie:

Before asking for a deposit, many platforms offer a demo version of the bot. On the surface, it looks great: consistent profits, smooth execution, and zero losses. But demo accounts are rigged.

They use fake money and ideal trading conditions to show perfect results. There’s no market risk, no slippage, and no unexpected events that happen in real trading every day. Once users are impressed and deposit real funds, they discover the actual bot (if it even exists) doesn’t perform as promised or doesn't work at all.

What Real Trading Companies Look Like?

Not all trading platforms are a scam. There are legitimate companies that utilize actual technology, operate within the law, and disclose both the risks and rewards. The problem is figuring out how to distinguish between them. Here’s what separates real trading companies from fake ones:

1. They Show Transparent Results - Including Losses

Legitimate trading companies don’t just show profits. They share real, verifiable performance data that includes both winning and losing trades. No trading strategy is perfect. If a company only shows success stories or charts that go straight up, it's likely hiding something.

2. They Clearly Explain the Risks

Real platforms care about investor protection. They typically go out of their way to alert customers to the dangers of trading. This is in the form of messages such as "past performance is not a guarantee of future results" and full disclosures. Many reputable firms are bound by law to include this type of information. It might not sound exciting, but it’s honest.

3. They’re Properly Registered and Regulated

Legitimate trading firms are registered with financial authorities like the SEC (USA), FCA (UK), SEBI (India), or other regional regulators. These registrations are public and easy to verify online. If a company avoids the topic of licensing or claims it doesn’t need regulation, that’s a major warning sign.

4. They Offer Real, Responsive Customer Support

Fake trading platforms usually don’t offer real customer support. They might only have a vague contact form or a generic email that leads nowhere. Trusted companies do things differently; they provide proper support through phone, email, or live chat. You can reach real people who understand the service and can help with your questions, whether it’s about trading or how the platform works.

What to Do If You Got Scammed?

If you’ve been caught in a fake trading bot scam, don’t panic. These scams are built to trick people, and it happens to many. The first thing to do is stop any payments right away. Cut off all contact with them, no matter what they say or promise next.

Contact your bank or payment provider as soon as possible. They may be able to reverse charges or block future transactions. Keep all evidence - emails, screenshots, and receipts - as this will help in filing a complaint.

Report the scam to the Federal Trade Commission or your local financial authority. This not only supports investigations but may help in future recovery efforts. Lastly, share your experience with others. Warning friends, family, or online communities can help prevent further victims.

Consult a crypto recovery specialist for fund recovery. In some cases, funds may be traced and recovered, particularly if the scammer used a centralized exchange, a KYC-verified wallet, or is linked to a known fraud network.

Do not Fall for Easy Profits

The idea of easy money is tempting, especially when times are tough. But these AI trading bot scams prey on that hope. The companies behind them spend millions on marketing because it works. They know exactly what to say to make their offers sound legitimate.

Remember, if these systems really worked, everyone would be using them. The fact that most professional traders and investment firms don't use these consumer bots tells you something.

Real investing requires patience, education, and accepting that there are no guarantees. It's not as exciting as the scammers make it sound, but it's honest, and it works over time.

Victim of an AI trading bot scam?

Get expert guidance and explore your recovery options with Financial Recovery Experts.

FAQs (Frequently Asked Questions)

A real trading company is registered with official financial bodies like SEBI or the FCA. They don’t hide their license. You’ll find clear details on their website, and they don’t avoid questions when you try to contact them.

No, they don’t. Honest trading platforms never promise that you’ll always make money. They clearly explain that all investments carry risk. If someone says you’ll earn daily or guaranteed returns, it’s a major warning sign of a scam.

Real companies offer proper customer support. You can talk to someone over phone, email, or chat if you have questions. They respond with helpful answers, not pushy sales talk or confusing messages that don’t make sense.

Yes, some real platforms use automated tools or bots. But they explain how everything works and give you full control. They never ask for big deposits with promises of easy profits. You decide how much to invest and when.

If a website promises quick profits, avoids giving company details, pressures you to deposit fast, or makes it hard to withdraw your money, it’s likely a scam. Real platforms are clear, honest, and never rush you into decisions.