- Crypto

- February 10, 2026

Cryptocurrency promises freedom from banks, brokers, and even government oversight. It’s just you, your assets, and the platform you choose to trust. But this very independence is where the darker side of crypto begins to emerge.

The truth is, many people can’t clearly tell the difference between a legitimate crypto platform and a fake one. And that gap in awareness? It’s exactly what scammers are counting on. They thrive in these grey areas, waiting for a moment to strike.

From the moment you step into the world of crypto, scammers are always one step ahead, watching, and ready to exploit your investments. And while scams can hit you at any stage, one of the most devastating tricks tends to surface much later in the journey: the Frozen Crypto Wallet Scam.

However, the scam doesn’t start when your wallet gets frozen. It begins the second you sign up on a fake or unverified platform. In this particular scheme, scammers lure you into investing through their seemingly trustworthy platform. Everything feels normal until you try to withdraw your funds. That’s when the trap is sprung: your wallet gets "frozen," and suddenly, your assets are locked away beyond reach.

Unfortunately, many investors, especially those new to crypto, don’t even realize what’s happening until it’s too late.

So, before we dig deeper into how this scam works, let’s first break down what a "frozen wallet" really is, how these fraudsters pull off the scheme, and most importantly, what you can do if you’ve already been caught in the net.

What is a Frozen Crypto Wallet Scam?

A frozen cryptocurrency wallet refers to a situation where your digital wallet becomes temporarily inaccessible. During this period, you're unable to do any kind of transactions like no transfers, no trading, and most crucially, no withdrawals. While legitimate platforms may occasionally freeze wallets for security reasons, scammers have begun exploiting this concept as part of a dangerous con.

In a Frozen Wallet Scam, the fraudster often impersonates a trusted authority such as a crypto platform representative, support agent, or regulatory officer. They lure you in with the promise of high returns or exclusive investment opportunities. Everything may seem smooth at first: your account shows increasing profits, your dashboard looks professional, and the communication feels convincing.

But the trap is set. When you finally try to withdraw your funds, your wallet is suddenly “frozen.”The scammer then pressures you to make an upfront payment. Unfortunately, no matter how much money you pay, the wallet remains inaccessible. You’ve not only lost your initial investment, but also the additional payments demanded to “unlock” it. The freeze is not a technical error; it’s a calculated move in a bigger scam.

Understanding this deceptive tactic is the first step toward protecting yourself. In the sections ahead, we’ll break down how this scam operates, the red flags to watch for, and what you can do if you or someone you know has been targeted.

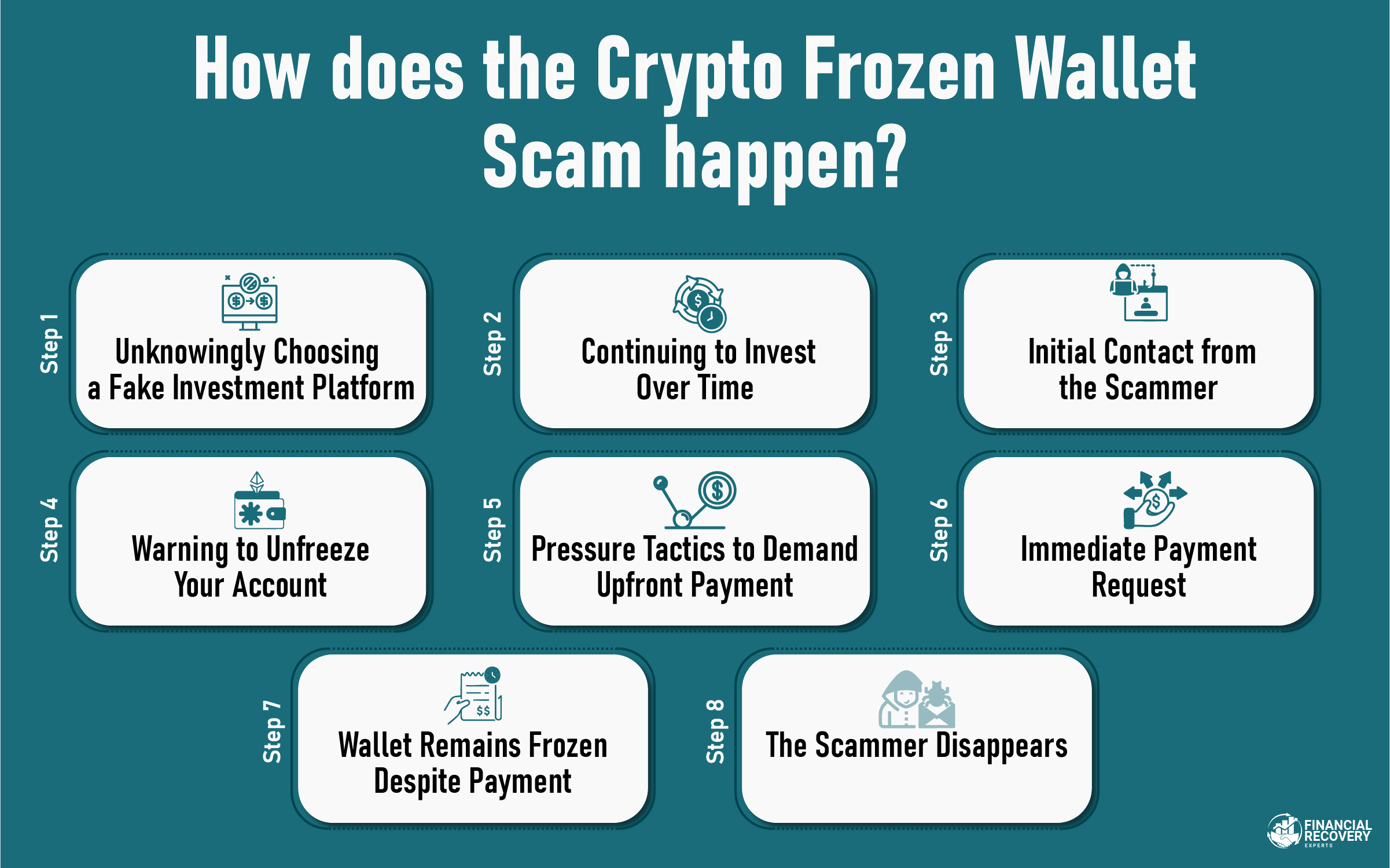

How does the Crypto Frozen Wallet Scam happen?

You might unknowingly invest a significant amount on a fake platform, and when you try to withdraw your funds, that’s when the scam begins. As soon as you initiate a withdrawal, you may receive a message or email stating that your account has been frozen. This isn’t a technical issue. It is a carefully planned and well-executed scam. To protect yourself or take action against it, it’s essential to understand how this scam actually works.

Following are the steps to help you identify fake platforms:

Step 1: Unknowingly Choosing a Fake Investment Platform

When you decide to invest, you begin searching for a platform and come across cryptocurrency as a popular option. While researching, a few “investment portals” may reach out to you directly, offering enticing schemes. They promise high returns, exclusive perks, and make it seem like they've saved you the effort of doing more research. It feels convenient, so you sign up without realizing it's a trap.

Step 2: Continuing to Invest Over Time

You register and start investing. Over time, your portfolio appears to grow significantly. Everything looks promising until you attempt to withdraw your funds. That’s when you discover your account has been frozen.

Step 3: Initial Contact from the Scammer

At this point, the scammer contacts you usually via email, social media, or messaging apps. They pose as a platform representative or regulatory authority, claiming your account has been frozen due to a security or compliance issue.

Step 4: Warning to Unfreeze Your Account

The scammer informs you that to unfreeze your account, you must pay a fee. They may call it a compliance fee, security charge, tax on blocked funds, or platform processing fee, anything to make it sound legitimate.

Step 5: Pressure Tactics to Demand Upfront Payment

Once they have your attention, they pressure you to act quickly. They create a sense of urgency by claiming the fee must be paid within hours or you'll permanently lose access to your funds. You’ll see buttons and prompts like “Act Now” or “Pay Immediately” to push you into acting without thinking.

Step 6: Immediate Payment Request

They ask you to send the payment typically in cryptocurrency to a wallet address they control. They may continue using high-pressure tactics to get you to pay without delay.

Step 7: Wallet Remains Frozen Despite Payment

Even after you make the payment, your account stays frozen. You still can’t access your funds or view any transactions. The scammer continues to delay with excuses or completely stops responding.

Step 8: The Scammer Disappears

Eventually, all communication stops. The website or contact platform disappears, your messages go unanswered, and you’re blocked from every channel you were using to talk to them. By then, the scammer has vanished, and so has your money.

Case Study: Frozen Wallet Scam Linked to a Fake Investment Platform

In 2025, U.S. authorities identified several fake cryptocurrency investment platforms that were designed to look like real trading websites. These platforms showed live charts, account balances, and steady growth, which gave users confidence to invest. People deposited cryptocurrency believing they were using a legitimate service, and many continued investing after seeing profits displayed on their dashboards.

Problems began when users tried to withdraw their funds. Withdrawal requests were delayed, rejected, or marked as “under review.” In some cases, the platform claimed extra payments were required before funds could be released. This left victims in a frozen wallet situation, where their balance was visible on the screen but completely out of reach. Over time, communication stopped, and the platforms became inactive, making access to the funds impossible.

Investigations later confirmed that these platforms were fully controlled by scammers. Law enforcement seized several related domains and froze some associated wallets to prevent further losses. While not every victim recovered funds, these cases helped expose how fake investment platforms operate and how a frozen wallet often results from platform control rather than a blockchain error.

Understanding how these scams work makes it easier to spot warning signs early. The next section explains practical tips to identify fake investment platforms and avoid frozen wallet scams before any money is sent.

Tips to Identify and Avoid This Scam

If you suspect that you may have fallen victim to this type of scam, the first step is to know how to identify and confirm it. We've listed a few key points that can help you assess your situation and investigate further.

Research and Verify about the platform before investing:

To avoid falling for a crypto scam, it's important to thoroughly research any platform before investing. Legitimate platforms are typically licensed and regulated by reputable authorities. Be cautious of platforms that promise guaranteed high returns, unusually low fees, or exclusive offers. Always double-check the domain age using tools like lookup.icann.org. If the website is new but claims to be well-established, proceed with extreme caution.

How to Check for Regulation and Licensing:

These points will guide you to check regulation and licensing of the platform you are choosing to invest in.

- Look for License Registration number on their website.

- Find their registration details on official bodies like the SEC in the U.S. or FCA in the UK.

- Make sure the platform is registered and regulated as per jurisdiction.

- Check for accurate logos and official’s signature on any certificate.

- Search for complaints and warnings.

Investment platforms cannot freeze your account without notice

You should be immediately alarmed if your crypto wallet is frozen without any prior warning or legitimate explanation. However, if your wallet suddenly becomes inaccessible and you receive a message, especially from unofficial or untraceable sources like random emails, unknown numbers, or suspicious messaging apps, that is a strong indicator of a potential scam.

Unverified support team

If your crypto wallet is suddenly frozen, you might receive a call from someone claiming to represent the platform. Before you respond or engage, take a moment to verify the details. A legitimate crypto platform will never contact you using a personal phone number or an unofficial email address. Professional communication is always done through verified, secure channels. Scammers often pose as support agents or compliance officers from well-known platforms. They’ll sound convincing and may even reference details from your account to gain your trust. However, this is a common tactic to manipulate you into acting quickly without verifying anything.

Demanding upfront payments

Genuine investment platforms do not ask for large upfront payments to access your own funds. Scammers operating fake investment platforms often take advantage of your panic, claiming that your funds are frozen and will be lost unless you act immediately. Their goal is to trick you into sending a large sum before you have time to think it through. Be especially cautious if you're asked to make the payment in cryptocurrency which is harder to trace and recover.

Are you a Victim? Here is what you should do

After getting information about identifying the fake platforms and the scammers, now it is important to know what to do if you are going through such scams. Follow the below given steps.

- Cut off all the communication with their ‘so-called support team’. The more you stay in their contact the more easily they can track you down. So avoid clicking any link even if the title seems helpful. If you receive calls or texts, do not respond or click on any links.

- Once you stop communicating, gather all the documents. Save every piece of communication you had with the scammer, including emails, chat messages, call logs, text messages, and social media exchanges. Don't forget to preserve timestamps because they help establish a timeline of the scam. These can be used against them if you are looking forward to filing a complaint.

- Search for a genuine recovery firm and contact them. One such firm is Financial Recovery Experts. Remember! Scammers can get back to you posing as a recovery firm. Learn the difference between fake recovery firms and genuine recovery firms. If someone claims funds are stuck and offers recovery service for a fee, treat it as another scam.

- Do not share private passkeys, seed phrases, or screenshots of your assets with anyone. Scammers often pose as support agents, influencers, or even friends, pretending to help and might say, "Just share your passkey so we can verify ownership,” or ask for a “screenshot of your wallet”; these are traps. The moment you provide such details, you’re handing them the keys to your funds.

Stay Calm, Stay Informed, Stay Protected

Discovering that your crypto wallet is frozen can be overwhelming, and feeling anxious in that moment is completely normal. Scammers rely on panic and urgency to push people into rushed decisions. The more pressure you feel, the more important it is to slow down and pause before taking any action.

A genuine crypto platform or authority will never demand immediate payments, taxes, or verification fees to release your funds. Take time to verify who you’re dealing with, review the messages you’ve received, and avoid responding to anyone creating fear or deadlines. Acting calmly helps you think clearly and prevents further loss.

If you’re unsure whether your wallet is truly frozen or part of a scam, speaking with a trusted professional can help you understand the situation. Financial Recovery Experts can review the details of your case and explain possible next steps, without pressure or advance payment. Having clear, unbiased guidance can help you regain control and move forward safely.

FAQs (Frequently Asked Questions)

Cold wallets (self‑custody) can’t be frozen. Only custodial wallets (e.g., on exchanges) might be - by legitimate authorities or during platform security incidents.

Stop all contact, report the scam, and consider hiring a crypto asset tracing firm.

Check public blockchain activity. If funds are moved to another address, it’s theft. Blockchain explorers trace the path.

Yes - many countries now have laws allowing freezing of illicit crypto via court orders (e.g., UK’s CWFO from April 2024)