- Investment

- July 8, 2025

Scams have always followed the money. As AI becomes more common in tools and services, scammers are now using it too, not to help, but to trick. These new scams look smarter, act faster, and are often harder to spot.

They don’t always start with wild promises. Some look professional. Some even use real company names or fake screenshots that show “returns” powered by AI. It’s not just beginners who fall for them. Many people who’ve been investing for years have lost money to schemes that looked legit on the surface.

Let’s go over what makes these scams different, the signs you can look out for, and how to avoid becoming a target.

Why Smart People Still Fall for It?

Many scams rely on urgency or excitement. AI scams do the same, but they add something extra, tech language that makes things feel advanced and credible.

It's easy to think like “This looks smart, so it must be real.” The truth is, some of the most convincing scams are designed to target people who already know the basics of investing. They’re not always chasing beginners. They’re going after those with money, experience, or interest in tech.

They do this by making the scam look “smart enough.” They might claim the returns come from algorithm-based trades or machine learning models that study markets in real time. Most people don’t know how to verify that, so they accept it at face value.

And when people often see results, even fake ones, their guard drops. They might even show their money “growing” on a dashboard, which makes them think it’s working. They make them believe to wait longer or put more money for more profit. That’s how people get pulled in.

AI Buzzwords That Should Raise Red Flags

Scams have always followed the money. As AI becomes more common in tools and services, scammers are now using it too, not to help, but to trick. These new scams look smarter, act faster, and are often harder to spot.

They don’t always start with wild promises. Some look professional. Some even use real company names or fake screenshots that show “returns” powered by AI. It’s not just beginners who fall for them. Many people who’ve been investing for years have lost money to schemes that looked legit on the surface.

Let’s go over what makes these scams different, the signs you can look out for, and how to avoid becoming a target.

Why Smart People Still Fall for It?

Many scams rely on urgency or excitement. AI scams do the same, but they add something extra, tech language that makes things feel advanced and credible.

It’s easy to think like “This looks smart, so it must be real.” The truth is, some of the most convincing scams are designed to target people who already know the basics of investing. They’re not always chasing beginners. They’re going after those with money, experience, or interest in tech.

They do this by making the scam look “smart enough.” They might claim the returns come from algorithm-based trades or machine learning models that study markets in real time. Most people don’t know how to verify that, so they accept it at face value.

And when people often see results, even fake ones, their guard drops. They might even show their money “growing” on a dashboard, which makes them think it’s working. They make them believe to wait longer or put more money for more profit. That’s how people get pulled in.

AI Buzzwords That Should Raise Red Flags

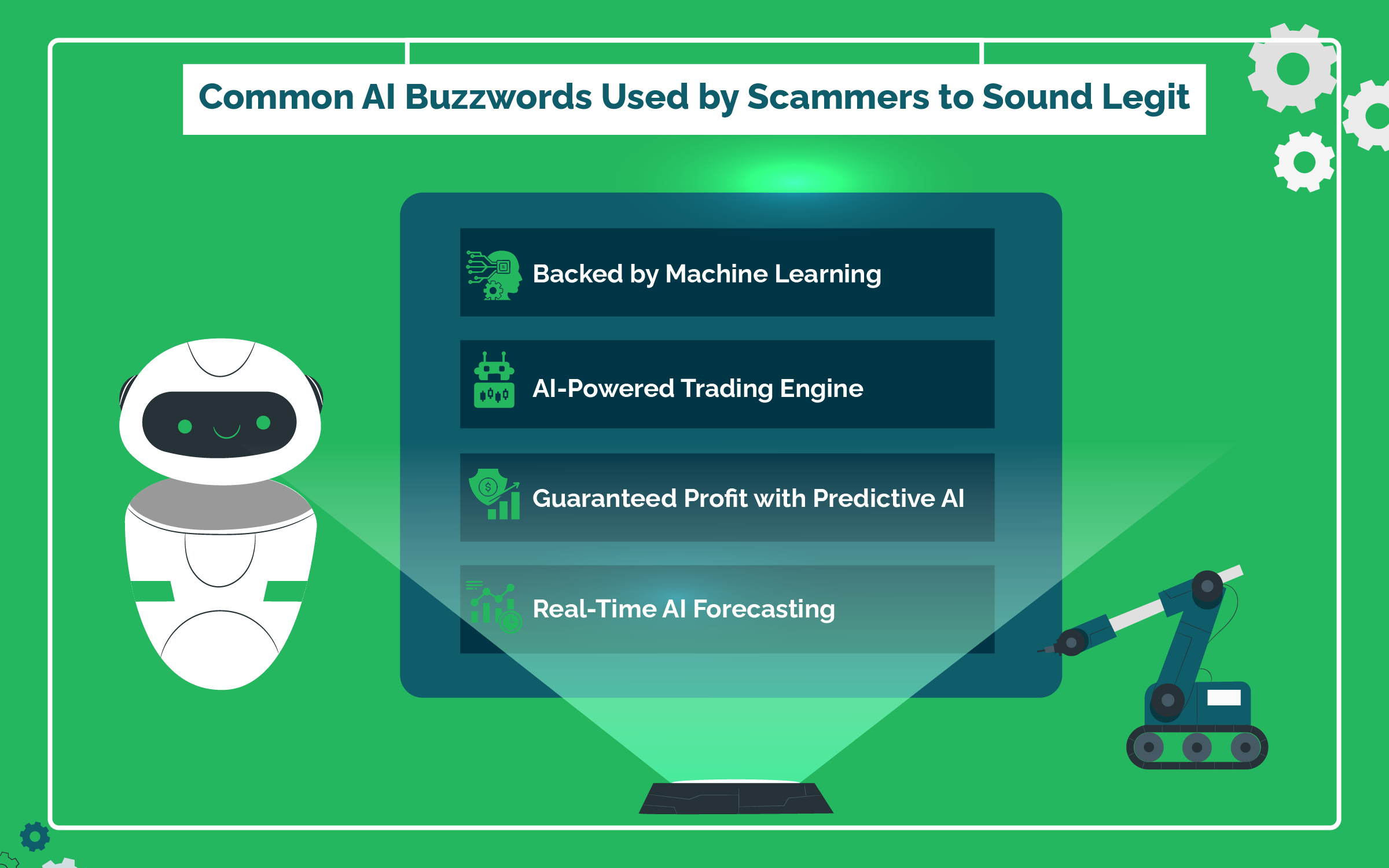

Scammers love buzzwords. They know that if it sounds smart, it feels safe. But words can lie. Here are a few common phrases that should raise an eyebrow:

- “Backed by Machine Learning”: This sounds advanced, but it’s vague. If the site or person doesn’t explain their model and from which data it was trained clearly, they’re probably using the term just to sound impressive.

- “AI-Powered Trading Engine”: In real finance, trading engines take years to build and test. If someone is promising a flawless “AI engine” that just prints money, be skeptical. Even the best hedge funds lose sometimes.

- “Guaranteed Profit with Predictive AI”: No AI can predict the market with 100% accuracy. If it could, nobody would be poor. Markets are unpredictable, and anyone guaranteeing profit is lying.

- “Real-Time AI Forecasting”: Again, it sounds good, but without proof of how these forecasts are made, it means nothing. Forecasts are guesses, even when an algorithm makes them.

Some scammers even mix in crypto terms or blockchain tech just to make it more confusing. If the words don’t explain how something works in plain terms, don’t trust them.

5 Red Flags You are Not Trained to Spot

Not all red flags are obvious. Many scams today don’t have spelling errors or messy websites. Some look well-designed and professional. But there are still clues. Here’s what to watch for:

1. Returns That Never Drop: Real investments go up and down. If your balance always rises and never falls, even slightly, it’s likely fake. A slow, steady “up” is often used to keep you feeling safe and excited.

2. Complicated Dashboards That Distract: Some fake platforms fill the screen with data, graphs, and fake trades. It looks busy and real. But it’s just visual noise to stop you from asking hard questions.

3. Withdrawals Delayed or Blocked: A classic scam move. At first, they let you take out small amounts. Then, after you invest more, the delays begin. They say there’s an error. Or they ask for more money to “verify” your account.

4. Unverifiable “Success Stories”: Testimonials are everywhere. Some even include fake LinkedIn profiles or stolen photos. If you can’t trace those people outside the platform, don’t trust their stories.

5. Fast-Talking Support or Pushy Sales: You might get a call from someone acting like a broker or advisor. They talk fast, name-drop well-known firms, and try to pressure you. This is often scripted. Real advisors won’t push you like this.

How AI Scams Play With Your Emotions?

AI might power the scam, but psychology closes the deal. Most people don't realize how much scammers rely on emotional tricks, not just tech tricks. These scams don’t always sell a product; they sell the feeling. That feeling might be excitement, trust, safety, or FOMO (fear of missing out).

Here are a few emotional plays that scammers commonly use:

1. They Make You Feel Lucky: Some platforms make you feel like you’ve been “selected” to test a new AI tool or join an exclusive group. That kind of attention can feel special, and it lowers your guard.

2. They Use Authority and Trust Symbols: Fake LinkedIn profiles, logos of big banks, and screenshots that show connections to known companies are not proof. They’re just a decoration set up by scammers. The goal is to make you trust the brand without checking.

3. They Build Progress Slowly: You might first be shown a $50 profit, then $200, and even $1000. Then they suggest that you deposit more. That fake growth is a hook, and you think, “This works; now I should go bigger.” But the end goal is always to take a much larger amount.

4. They Trigger Urgency: Time-limited bonuses, only a few “slots” left, and messages like “this AI is about to go public” are traps to get you to act fast and skip research. And eventually make you invest in thinking it's a great deal.

Once someone is emotionally invested, they’re more likely to invest money. Scammers count on that.

What to Do Before Sending Any Money?

The best defense is caution. Before putting even a small amount into any platform that uses AI or advanced trading terms, these steps can help you:

1. Research the Platform Thoroughly: Search for reviews, not just on the site, but on Reddit, Trustpilot, forums, and even scam reporting databases. Look for complaints about withdrawal issues, aggressive upselling, or fake promises. If all reviews look too perfect, it’s probably curated.

2. Ask Specific, Hard Questions: Don’t settle for vague answers or flashy explanations. Ask direct questions that require real details. If the answers are full of buzzwords or they avoid giving straight information, that’s a warning sign. Real companies always answers straightforward questions. Scams deflect them, stall, or confuse someone with complicated language.

3. Check Regulatory Status: Look up the company in official databases. If they say they’re regulated, verify it yourself. In many countries, investment platforms need to register with financial authorities. If they’re not listed, you’re taking a big risk.

4. Start With the Mindset That It Could Be a Scam: This helps you keep your emotions in check. Don’t assume it’s legit and look for reasons to prove it. Instead, assume it could be fake and look for reasons it’s real. That shift changes how you look at the details.

5. Talk to Someone Who Has Nothing to Gain: This could be a financial advisor, a friend who knows the space, or someone outside the hype. If a platform discourages you from doing this, take that as a warning sign.

6. Report the Scam: If one has already lost money, report it immediately. File complaints with cybercrime units, financial regulators, and platforms like Chainabuse. Even if you think the amount is small, it helps build a case.

One can also reach out to financial recovery services like Financial Recovery Experts or similar firms that specialize in tracking crypto transactions and helping victims recover their lost funds.

What the Scammers Are Doing Next?

Scammers are getting harder to notice. Many no longer rely on flashy websites. Instead, they run private groups on apps like Telegram or WhatsApp, spaces that feel more personal and harder to question.

Some are also starting to use deepfake videos and voice clips. For example, one might see a fake video of a well-known investor promoting an “AI tool” they’ve never actually used.

Some are using tools that copy how real people talk, pulling from your online habits to make replies sound familiar. It’s less about fooling the crowd now and more about quietly convincing one person at a time.

The goal now isn’t just to fool others but to earn others' trust slowly, then strike when their guard is down.

FAQs (Frequently Asked Questions)

Yes, some AI tools are used by legitimate firms to analyze markets. But these tools are complex, expensive, and usually serve big institutions. If someone claims their AI system guarantees returns for retail investors, it's likely a sales pitch or worse, a scam.

A real startup will tell you the risks upfront. They’ll be transparent about their team, show proof of their product working, and won’t promise guaranteed results. Scams, on the other hand, offer certainty with no accountability.

Yes. Every report helps. It may not get your money back, but it helps track scam networks and warn others. You can report to platforms like Chainabuse, your national cybercrime unit, or financial regulators.

No. Most legit platforms don’t reach out to users this way. If someone you don’t know sends you a “hot” investment tip or invites you to a group that talks about profits, it’s most likely part of a coordinated scam effort.

Absolutely. Many scam websites are well-designed. Some even copy real company pages. Design means nothing if the operation behind it is shady. Focus on what they’re asking from you, not just how it looks.