- Investment

- July 8, 2025

Cryptocurrency and digital finance have created more opportunities to grow wealth, but they've also opened the door for smarter, more convincing scams. The latest threat is the fake investment platforms built using AI.

At first glance, these websites look completely normal. They have professional dashboards, live support chats, and testimonials from supposed investors. But such sites might not be real.

Moreover, scammers are now using advanced tools to build fake investment platforms that look and feel real. These sites are clean, fast, and convincing, often better than some genuine platforms; that’s what makes them so dangerous.

Let’s look at how these scams actually work, what signs to watch out for, and how you can keep your money safe.

What Is an AI-Generated Investment Scam?

AI-generated investment scams are websites or apps that pretend to offer legitimate investment services. They may claim to trade crypto, forex, stocks, or new tokens. They show you fake balances, market stats, and profits, all designed to make you think your money is growing.

But the entire setup is fake. They just built a platform that looks and acts like a real one to trick you into depositing funds. These platforms often use AI tools to:

- Write convincing content

- Build fake customer reviews

- Create fake expert bios

- Run chatbots that sound helpful

- And manage fake social media campaigns

The result is something that looks professional and can fool even experienced users.

Why Fake Platforms Feel So Real?

Cryptocurrency and digital finance have created more opportunities to grow wealth, but they’ve also opened the door for smarter, more convincing scams. The latest threat is the fake investment platforms built using AI.

At first glance, these websites look completely normal. They have professional dashboards, live support chats, and testimonials from supposed investors. But such sites might not be real.

Moreover, scammers are now using advanced tools to build fake investment platforms that look and feel real. These sites are clean, fast, and convincing, often better than some genuine platforms; that’s what makes them so dangerous.

Let’s look at how these scams actually work, what signs to watch out for, and how you can keep your money safe.

What Is an AI-Generated Investment Scam?

AI-generated investment scams are websites or apps that pretend to offer legitimate investment services. They may claim to trade crypto, forex, stocks, or new tokens. They show you fake balances, market stats, and profits, all designed to make you think your money is growing.

But the entire setup is fake. They just built a platform that looks and acts like a real one to trick you into depositing funds. These platforms often use AI tools to:

- Write convincing content

- Build fake customer reviews

- Create fake expert bios

- Run chatbots that sound helpful

- And manage fake social media campaigns

The result is something that looks professional and can fool even experienced users.

Why Fake Platforms Feel So Real?

One of the biggest reasons people fall for fake platforms is how real they feel. The support chats respond instantly, and the answers sound thoughtful. Ask a question about your account or how something works, and you'll get a reply that seems helpful and personal, which is a trap.

Further, scammers use smart tools that can have a real back-and-forth with you. They answer your questions, give advice, and even remember details you’ve shared before. It’s easy to feel like you’re talking to someone trustworthy who really wants to help.

These fake support chats are available around the clock. Whether it’s early morning or late at night, someone or something is always there to respond. This constant interaction builds trust quickly, and before you know it, you're convinced the platform is legit.

When AI Creates Non-Existent Experts

A common trick scammers use is building fake teams. These sites often show a “management team” or “advisory board” full of people with strong resumes and clean profile pictures. But in reality, none of them exist.

Using AI, scammers can create realistic faces of people who’ve never lived. They can write bios that include fake job history, education, and media coverage. Some even link to fake LinkedIn profiles or articles that were never published.

These profiles help you build credibility. When you see that a project is run by professionals or think it’s backed by big names, you’re more likely to trust it. And scammers just need a few clicks of assumed trust.

How AI Chatbots Are Used to Gain Trust?

Fake investment platforms often have customer support chat features that seem legit. Ask a question, and you’ll get a fast, clear answer. The bot will sound friendly, and it might even remember your name or reference your earlier questions.

These bots are built using AI tools. Unlike old scams where responses were slow or awkward, these new chatbots respond naturally. They help you reset passwords, guide you through deposits, and walk you through the “investment” process.

This kind of support makes the site feel real. It lowers your suspicion. You feel looked after, even if it’s all part of the trap.

In some cases, these bots are designed to discourage withdrawals or convince users to deposit more. They may say things like, “Your account is almost eligible for a bonus payout. Just add $250 more to qualify.”

These aren't just scripts; they adapt based on how you respond. That’s where the AI part comes in, and that’s what makes them dangerous.

How Scammers Use Social Media to Spread Fraud?

Many fake investment platforms don’t rely only on websites. They promote their scams across social media. Instagram, Twitter, TikTok, Telegram, and even YouTube have become places where scammers look for victims.

They post fake success stories, show edited screenshots of huge profits, or claim they’re part of an exclusive trading group. Some even hire influencers, knowingly or unknowingly, to promote their platforms.

In some cases, AI is used to create these videos and posts. Deepfake tools can create videos of “investors” talking about how much they’ve made. AI voice cloning can even generate convincing voiceovers for testimonial reels.

It’s easy to get pulled in when you see someone just like you saying they made $10,000 in a month. That’s the goal: to make it feel normal and repeatable.

The truth is, it’s just content made to go viral. Behind the scenes, there’s no real investment, no real profit, and no real platform.

How To Spot The Red Flags Before Its Too Late?

Here are some of the signs that can help you spot a fake investment platform, even if it looks clean and professional.

1. Unrealistic promises: If a platform guarantees high returns with little or no risk, that’s a big warning sign. Real investments don’t work that way. No legitimate site can promise fixed profits, especially in something as volatile as crypto. Scammers say what you want to hear to get your money fast.

2. No regulatory info: Most trusted platforms clearly show their licensing and regulatory details. If you can’t find this info, or worse, if it looks made up, stop right there. Some scammers copy registration numbers from real platforms or use logos to look legit, but they won’t hold up under a proper check.

3. Fake reviews and testimonials: Scammers often flood their websites and social pages with fake reviews. These can be written by bots, copied from other platforms, or created using AI. Try searching for the same review phrases or images online. If they show up in multiple places with different names, you’re looking at recycled lies.

4. Suspicious pressure tactics: A classic move is creating urgency, saying things like “Only a few spots left” or “This offer expires in 2 hours.” Real investment services don’t chase anyone down or beg them to act fast. If someone’s rushing you, they’re trying to stop you from thinking it through.

5. No clear company info: If the website doesn’t list a real address, verified contact details, or legal ownership info, that’s a red flag. Even if they give you some details, cross-check them. Fake platforms often use virtual addresses or hide behind layers of vague corporate names to stay out of reach.

How to Protect Yourself from AI-Driven Scams?

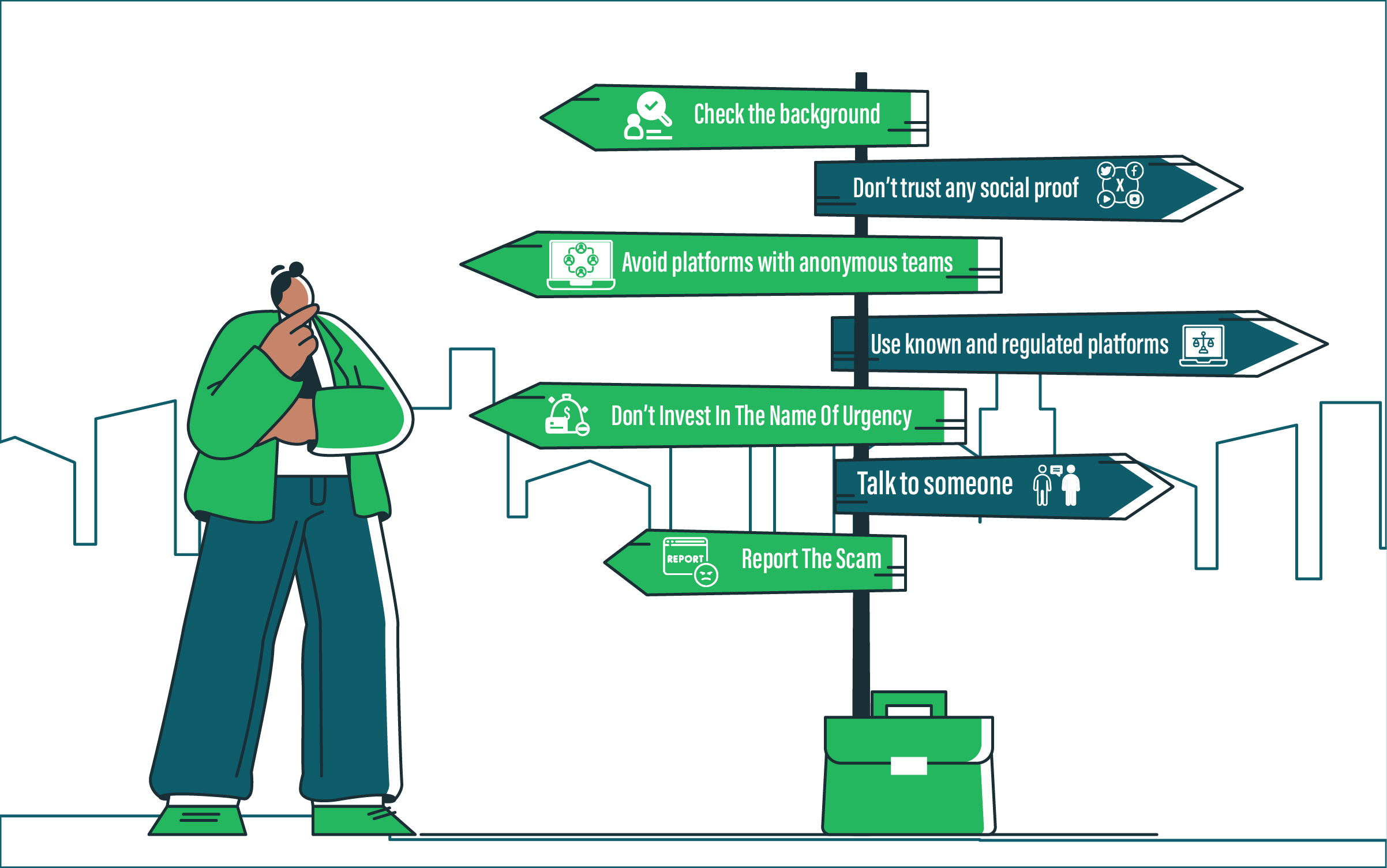

Avoiding these scams isn’t just about spotting them; it’s also about building good habits, which can help someone to protect themselves from such AI scams:

1. Check the background: Before putting money into any platform, search its name with words like “scam,” “complaints,” or “reviews.” If others have had bad experiences, you’ll likely find discussions or warnings online. A legit platform should have a digital footprint that checks out.

2. Don’t trust only social proof: Just because a post has thousands of likes or comments doesn’t make it real. Fake platforms often buy engagement or use bots to push fake success stories. Always verify claims independently instead of trusting what looks popular.

3. Avoid platforms with anonymous teams: If a platform hides who’s behind it or lists fake names and bios, that’s a major red flag. Real companies stand behind their teams. If there’s no way to verify who's running the show, it’s not worth the risk.

4. Use known and regulated platforms: Stick to platforms that are officially registered with regulators in your country. Most financial authorities have searchable databases where you can check if a company is licensed. If you can’t find the name, walk away, no matter how polished the site looks.

5. Don’t invest based on urgency: Take your time before taking any decision, as scammers love to create pressure with phrases like “limited-time bonus” or “offer ends today.” But legitimate investment options don’t vanish overnight. Rushing leads to regret, so slow down and think it through.

6. Talk to someone: If something feels off, ask a friend, a financial advisor, or anyone you trust with experience. Sometimes, talking with someone can help one realise something and consider their investment.

7. If you’ve been scammed, take action quickly: Stop communication with the platform immediately. Save every message, screenshot, and transaction detail. Report the fraud to your bank and local authorities. You can also turn to platforms like Financial Recovery Experts, which specialize in helping victims trace and respond to online financial scams. Early action increases your chances of damage control or recovery.

Why AI Scams Are More Dangerous Than Ever?

Scams aren’t new, but the way they’re being carried out is changing fast. What once looked sketchy and full of obvious red flags now feels polished, real, and trustworthy. AI has helped scammers erase many of the usual warning signs people relied on to stay safe.

Now, a single scammer can run what looks like a full company, complete with customer support, fake team bios, realistic testimonials, and a slick website. They can clone the look of trusted platforms, generate fake market data, and even target users with personalized messages based on their behavior.

What makes AI-driven scams especially dangerous is their ability to scale and adapt. Scammers can launch multiple fake platforms at once, tweak their content to avoid detection, and use deepfake videos or voice clones to fool people in ways that weren’t possible before. These aren’t just scams; they’re full productions built to manipulate and deceive.

FAQs (Frequently Asked Questions)

Stop all communication with the platform. Save all messages, screenshots, and transaction records. Report the scam to your bank and local cybercrime unit. You can also use platforms like Chainabuse to file a report. If you're lucky, fast action can stop further damage.

In most cases, no, especially if you used crypto. However, if you used a card or bank transfer, contact your provider immediately. They may be able to reverse the charge or at least flag the transaction.

Report to your country’s financial watchdog and local law enforcement. For example, in the U.S., you can report to the SEC and FTC. In the U.K., use Action Fraud. In India, file a report through the National Cyber Crime Reporting Portal.

Visit the website of your national financial regulator. Look up the company name or license number. If it’s not listed, don’t use it, no matter how real it looks.

Watch for answers that sound generic or overly polite but lack substance. Ask specific questions about licenses, team members, or fees. If the answers are vague, evasive, or repetitive, it’s likely a bot.